Commercial Property Conveyancing

- Protect your commercial property purchase with detailed legal checks.

- Remove risk from zoning leases and settlement contracts.

- You will never be surprised by our fees. Conveyed’s prices are fixed and transparent, fully explained in advance.

- Relax, being fully supported during negotiations, inspections, and finance reviews.

- Enjoy full protection because we’ll check all ownership details and explain all your future tax obligations.

Check out 10 confirmed reasons that highlight the service you’ll get from us.

Get your quote today.

Relax knowing our experts are handling your property conveyancing.

Multiple Industry Awards

Receive guidance recognised through multiple industry awards.

Decade-long Experience

Rely on experience built across more than a decade of commercial matters.

120+ Verified Stellar Reviews

Trust decisions supported by over 120 independently verified excellent reviews.

Local Knowledge and Expertise

Benefit from suburb-specific insight shaped by repeated local transactions.

Difficult Transactions Handling

Resolve complex cases other firms decline or delay.

Full Legal Protection

Obtain full legal scrutiny across every contract annexure and disclosure.

Hidden Risk Control

Protect yourself from hidden risks through the proactive approach Conveyed provides.

Dispute Prevention Process

Avoid downstream disputes with our strategic contract structuring.

Zero-risk Negotiations

Delegate difficult negotiations to our experienced experts.

Creative Problem Solving

Minimise edge-case risks due to our creative legal problem-solving.

Why Conveyed is the Right Commercial Partner for You

Here are 8 reasons to choose an expert conveyancing team, led by Melissa Barlas.

- Specialized Commercial Focus – Residential conveyancing knowledge is not enough. Conveyed has extensive experience with high-value commercial assets. Our track record is solid.

- Local Insight: Our local knowledge of zoning details helps you get great deals and avoid bad investments.

- Fixed Commercial Fees – A fixed quote covers the whole legal procedure. You’ll know your financial liabilities from day one.

- Speed and Efficiency – Melissa Barlas and the team know that time is money. So all delays that stall development projects will be prevented completely.

- Risk Mitigation – For you, we’ll flag all property purchase risks. Environmental or structural legal issues are spotted.

- Complete Oversight – Real estate agent and tenant communications are handled. The transaction moves forward without friction.

- Attention to Lease Details – A bad lease destroys value. Our experts read every word to find hidden costs or contractual conditions. Conveyancing law is applied to protect you (as the landlord or buyer).

- Proven Results – Business clients trust our system. We’ve got over 110 reviews that prove we generate positive outcomes.

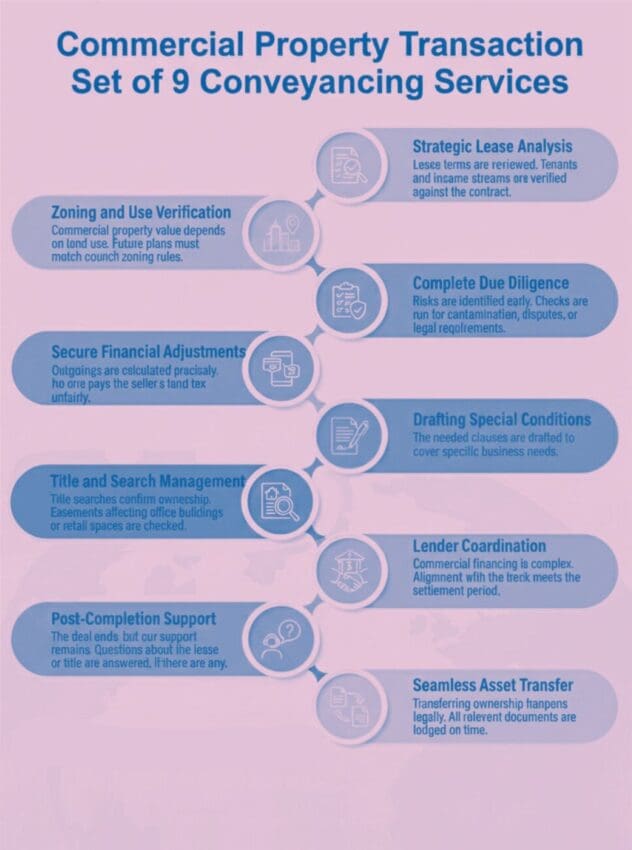

Maximise Value & Profit with Our Full Set of Conveyancing Services

Commercial property transactions require precision. That’s exactly what you’ll get.

- Strategic Lease Analysis – Lease terms are reviewed. Tenants and income streams are verified against the contract.

- Zoning and Use Verification – Commercial property value depends on land use. Future plans must match council zoning rules.

- Complete Due Diligence – Risks are identified early. Checks are run for contamination, disputes, or legal requirements.

- Secure Financial Adjustments – Outgoings are calculated precisely. No one pays the seller’s land tax unfairly.

- Drafting Special Conditions – The needed clauses are drafted to cover specific business needs.

- Lender Coordination – Commercial financing is complex. Alignment with the bank meets the settlement period.

- Title and Search Management – Title searches confirm ownership. Easements affecting office buildings or retail spaces are checked.

- Seamless Asset Transfer – Transferring ownership happens legally. All relevant documents are lodged on time.

- Post-Completion Support – The deal ends, but our support remains. Questions about the lease or title are answered, if there are any.

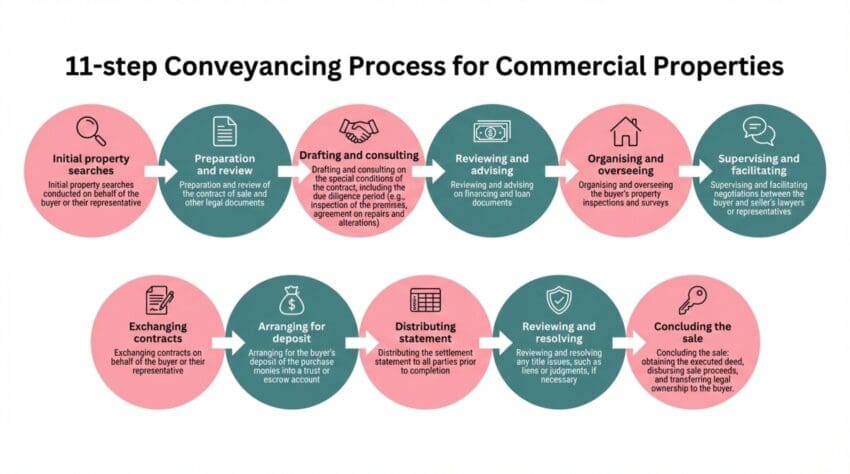

11-step Commercial Conveyancing Process for You

- Initial property searches conducted on your behalf.

- Preparation and review of the contract of sale and other legal documents.

- Drafting and consulting on the special conditions of the contract, including the due diligence period.

- Reviewing and advising on financing and loan documents.

- Organising and overseeing the buyer’s property inspections and surveys.

- Supervising and facilitating negotiations between the buyer and seller.

- Exchanging contracts.

- Arranging for the buyer’s deposit.

- Distributing the settlement statement to all parties before completion.

- Reviewing and resolving any title issues.

- Concluding the sale: obtaining the executed deed, disbursing sale proceeds, and transferring legal ownership to the buyer.

5 Types of Commercial Properties We Handle in Melbourne

The team manages transactions for many site types, including:

- Business Premises – Owner-occupier sites need a clear title for future growth. Malissa, being an experienced commercial property conveyancing lawyer, handles that quickly and professionally.

- Retail Spaces – Shops and cafes require specific lease checks.

- Office Buildings – Multi-tenant sites need detailed rent roll analysis.

- Industrial Property – Warehouses and factories often have environmental concerns.

- Development Projects – Land for subdivision requires complex zoning advice.

Key Takeaways

- Definition of commercial property conveyancing: Commercial property conveyancing is the legal process of transferring ownership of properties used in business. It requires specialized expertise.

- Process Overview: The 11-step process includes contract preparation, due diligence, negotiations, financing, inspections, and finalizing ownership transfer.

- Key differences from residential conveyancing: Commercial conveyancing is more intricate and involves zoning laws, tax implications, tailored contracts, and broader risk management.

- Choose a conveyancer: Prioritize expertise in commercial property, transparency in fees, knowledge of the local market, and strong communication skills.

- Residential conveyancing services: A good conveyancer establishes ownership clarity through title investigation, confirms zoning compliance, analyzes lease terms for obligations and income, and protects client interests through 14 conveyancing services.

- Avoid common mistakes: Effective communication, thorough due diligence, careful lease reviews, and precise documentation are crucial to avoid costly errors.

Key Differences from Residential Conveyancing

The distinctions between commercial and residential conveyancing are based on the differences between commercial properties and residential properties. Although both entangle property transactions, commercial conveyancing is inherently more complex than residential conveyancing.

Legal obligations related to commercial properties are more stringent, often involving compliance with business regulations and potential commercial tax implications. The documentation required for commercial property conveyancing is more intricate, encompassing detailed contracts, financial statements, title searches, and more. On the other hand, residential conveyancing is comparatively simpler, focusing on ownership transfer and payment settlement.

When comparing commercial conveyancing to residential conveyancing, key differences include:

- Purpose of Property:

- Residential: Focuses on properties intended for personal living (homes or apartments).

- Commercial: Deals with properties for business use, such as offices, retail spaces, or industrial facilities.

- Complexity:

- Residential: Typically involves straightforward processes with standard contracts and fewer legal intricacies.

- Commercial: More complex, with considerations for zoning laws, lease agreements, planning permissions, and environmental regulations.

- Contractual Negotiations:

- Residential: Contracts are often standardized with less room for negotiation.

- Commercial: Contracts are more bespoke, involving detailed negotiations over terms like leases, tenant obligations, and special conditions.

- Regulatory Considerations:

- Residential: Governed primarily by laws protecting individuals, like first-time buyer incentives or stamp duty concessions.

- Commercial: Involves specific laws related to business use, tax implications (e.g., GST), zoning, and licensing.

- Due Diligence:

- Residential: Focuses on title searches, building inspections, and financing.

- Commercial: Involves deeper due diligence, including evaluating leases, tenant rights, compliance with environmental laws, and assessing existing liabilities.

- Timeframes:

- Residential: Transactions often have quicker timelines with standardized processes.

- Commercial: Transactions may take longer due to extensive negotiations, complex terms, and the need for legal approvals.

- Financial Implications:

- Residential: Typically involves personal mortgages or savings, with limited financial risks.

- Commercial: Larger financial stakes involving business loans, tax implications, and potential income from leasing.

- Stakeholders:

- Residential: Primarily involves the buyer, seller, and their legal representatives.

- Commercial: Includes additional stakeholders like tenants, property managers, government agencies, and sometimes investors.

- Lease and Tenancy Considerations:

- Residential: Limited to property ownership and personal use.

- Commercial: Often involves existing tenants, lease terms, and future rental income as part of the transaction.

- Risk Management:

- Residential: Risks are limited to title issues or property defects.

- Commercial: Involves broader risks, including compliance with laws, financial liabilities, and potential business disruptions.

10 Factors to Consider When Choosing a Good Conveyancer for Commercial Property Transactions

When selecting a conveyancer for commercial property, consider the following factors:

- Specialization in Commercial Property: Confirm the conveyancer has specific experience handling commercial property transactions, including leases, zoning laws, and development projects.

- Qualifications and Accreditation: Confirm the conveyancer is licensed and accredited by relevant legal or conveyancing bodies, such as the Law Society or the Legal Services Board, and is experienced in commercial law.

- Knowledge of Commercial Regulations: Look for familiarity with local and state laws regarding commercial property, including zoning restrictions, tax implications, and environmental regulations.

- Fee Transparency: Understand the fee structure, including professional fees and disbursements, and ensure there are no hidden charges. A clear, detailed quote is essential.

- Communication and Accessibility: Choose a conveyancer who is responsive, proactive, and able to explain complex legal matters clearly, especially for time-sensitive commercial transactions.

- Experience with Unique Commercial Needs: Verify their expertise in handling specific issues like lease agreements, easements, strata titles, and planning permits.

- Local Market Knowledge: A conveyancer with insights into the local commercial property market can provide valuable guidance on trends, valuations, and potential risks.

- References and Reviews: Check for recommendations, online reviews, or testimonials from previous clients who have engaged the conveyancer for commercial property dealings.

- Risk Management and Due Diligence: Ensure the conveyancer conducts thorough checks, including title searches, zoning compliance, and assessing risks such as liabilities or encumbrances.

- Insurance and Guarantees: Verify that the conveyancer carries professional indemnity insurance to safeguard your investment against potential errors or omissions.

Advice for Young Conveyancers: 5 Most Common Mistakes to Avoid

Mistake #1: Failing to conduct thorough due diligence

When conveyancers skip thorough checks of all relevant documents, serious issues will arise. If you find yourself in such a situation, it’s best to consult with a legal expert immediately to understand the potential impacts and explore corrective actions. To prevent such a mistake, review every document carefully. Look for any legal encumbrances before moving forward with the transaction.

Mistake #2: Overlooking lease details

Overlooking specific terms in a lease leads to serious future issues. If lease details are missed, you will face unexpected legal challenges. Should such a problem occur, go over the lease agreement with a legal expert to understand your options. You will need to renegotiate terms or deal with disputes. To avoid such an oversight, examine every clause in the lease documents. Ask questions to clarify any terms that seem unclear.

Mistake #3: Inadequate communication

Poor communication leads to misunderstandings or delays in conveyancing. Record all interactions and verify important points in writing to reduce confusion and keep everyone informed.

Mistake #4: Neglecting to advise on zoning laws

Neglecting to advise on zoning laws leads to serious consequences if conveyancers fail to properly research or inform clients about the local regulations affecting a property. If you realise zoning laws have been overlooked, consulting a zoning law expert is necessary to understand possible solutions or apply for rezoning. To avoid such errors, always check the current zoning status and any planned changes that will affect the property area. Proper verification prevents legal issues and ensures that the property use complies with local laws.

Mistake #5: Incorrect document filings

Incorrect document filings, such as wrong property descriptions or missing signatures, will invalidate a property transaction. If you encounter such an issue, you will need to resubmit the documents or start the process over. To prevent errors, double-check all documents for accuracy and completeness. Consider having them reviewed by a peer before submission. An extra step will save time and prevent costly mistakes, ensuring that all paperwork accurately reflects the transaction details.

If you are planning to enter commercial property conveyancing as a conveyancer, buyer, or seller, contact Melissa for a consultation. You will need 10+ years of experience to stand in your corner.

FAQs

______________________

How does commercial conveyancing differ from residential property conveyancing?

Commercial property conveyancing involves leases, GST, and zoning. It is more complex than residential property. We manage the specific business factors.

______________________

Why is due diligence longer for commercial property?

Commercial transactions require checks on tenants, environmental issues, and building permits. Everything is investigated to verify the asset’s value.

______________________

How is GST handled on the commercial property purchase price?

GST applies unless the sale is a going concern. The team assesses all transactions to see if the exemption applies. Ask for a GST assessment early to avoid a 10% surprise.

______________________

What happens with existing tenants during the sale?

Leases usually transfer to the new owner. The lease documentation will be verified and tenants notified of the change.

______________________

Is finance approval different for commercial sites?

Yes. Banks require lower loan-to-value ratios and more details. We’ll work with the lender to satisfy their stricter legal requirements.

______________________

Can I access the premises for a pre-settlement inspection?

Yes. Buyers are expected to check the office space or retail spaces before paying. Confirm the property condition matches the contract descriptions.