Niddrie Conveyancing: Be Protected from All Risks

Melissa Barlas and her Niddrie conveyancing team:

- Gets contracts right every time

- Protects your deal from risk

- Handles pressure without missing anything

- Knows Niddrie property law inside out

- Keeps your timeline on track

Multiple award-winning, rated with over 100 5-star reviews

Get your quote today.

Relax knowing our experts are handling your property conveyancing.

Choose a Conveyancer Who Knows Niddrie Property Inside Out

You don’t want surprises halfway through a deal. Properties in Niddrie can come with zoning overlays, heritage restrictions, or council rules that most buyers miss. A good Niddrie conveyancer who knows the area picks up on all of it—before you sign anything. You get advice based on real local experience, not guesswork.

No shock delays from permits, no legal mess from planning issues, and no problems with titles or boundaries later. You stay in control, your money stays safe, and your deal goes the way it should.

Conveyed, led by Melissa Barlas, has handled thousands of conveyancing matters in Niddrie over the past 10+ years. With over 100 five-star reviews, you’re working with one of the most trusted names in the area.

Protect Your Deal from Risk with the Right Support

Unapproved works and missing permits are common in Niddrie. You won’t be stuck fixing someone else’s mess after settlement.

Zoning rules and overlays in the area change often. Your contract will reflect the current rules, not outdated info.

Vague clauses and hidden conditions leave you open to legal trouble. You get clear terms that protect your money and your rights.

Get your quote today.

Relax knowing our experts are handling your property conveyancing.

Costs of Conveyancing in Niddrie

Contract Reviews Fees

- Residential titled: $330

- Residential off-the-plan: $440

- Commercial titled: $440

- Commercial off-the-plan: $660

Prices of Niddrie Conveyancing Services

- Prepare contract / Section 32 (Residential): $770

- Prepare contract / Section 32 (Commercial): $990

- Conveyancing with contract prep (Residential): $1,100

- Conveyancing without contract prep (Residential): $1,350

- Conveyancing with contract prep (Commercial): $1,100

- Conveyancing without contract prep (Commercial): $1,550

All prices listed above include GST. Disbursements are NOT included.

Handle Pressure Without Missing a Thing

Tight deadlines, last-minute changes, and unexpected issues are part of Niddrie property deals. You need someone who doesn’t crack under pressure.

Every document gets checked. Every date, clause, and payment is locked in properly.

When things heat up, you’ll be fully guarded, able to stay focused on your move, not on fixing problems. You won’t chase updates or fix mistakes—they don’t happen.

Get Your Contract Right Every Time with Conveyed’s Niddrie Conveyancing Services

A contract can hide problems you won’t see until it’s too late. Hidden costs, dodgy terms, or missing details can flip a good deal on its head.

You get clear advice before anything’s locked in. No nasty surprises later.

You’ll know your rights, your risks, and exactly where you stand. Everything is upfront, and everything is built to protect you.

Keep Your Timeline on Track from Start to Settlement

Delays hit hard when banks, agents, and paperwork don’t line up. You lose time, money, and sometimes the whole deal.

Every deadline is tracked, every step followed without gaps. You don’t wait around for things that should already be done.

You move forward without guessing what’s next. From first review to final settlement, your timeline holds.

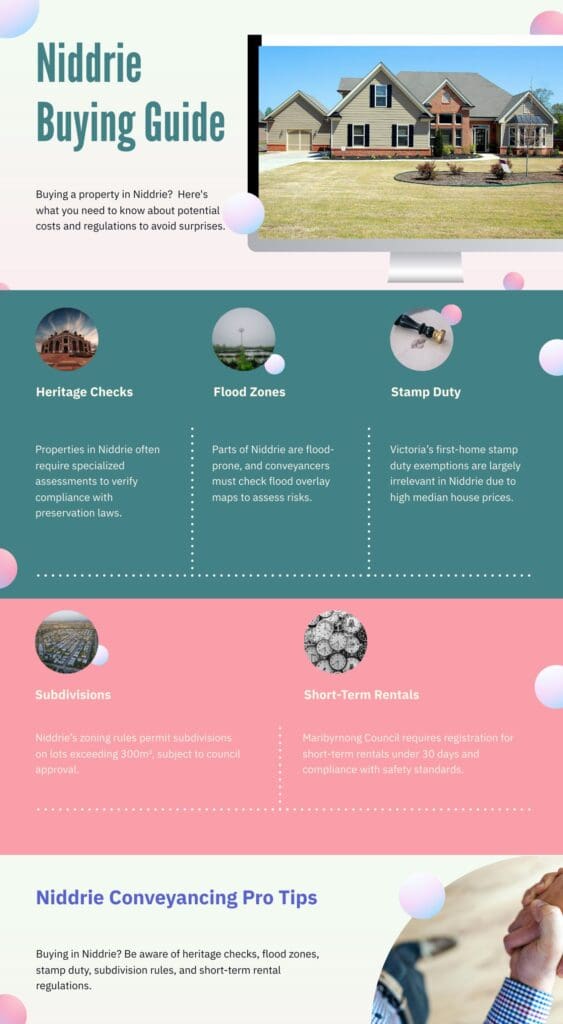

Pro Tips to Avoid Fines, Delays, and Surprises in Niddrie Conveyancing

Equip yourself to manage Niddrie’s property market, where auction clearance rates sit at 52–65% for houses, and days on market average 29–67 days.

Heritage Homes: Budget Extra for Compliance Checks

Heritage-listed properties in Niddrie often require specialized assessments to verify compliance with preservation laws, such as restrictions on façade changes.

TIP: Non-compliance leads to fines or forced restoration costs. Budget $800–$1,200 extra for legal checks.

Flood Zones: Confirm Conveyancers Use Up-to-Date Mapping Tools

Parts of Niddrie near Niddrie Burn and Burdiehouse Burn are flood-prone. Conveyancers must check flood overlay maps, such as Maribyrnong City Council’s flood management plans, to assess risks.

TIP: Unidentified flood risks devalue properties or lead to costly insurance premiums. Recent data shows flood-prone areas require specific contract clauses to protect buyers.

Stamp Duty: First-Home Exemptions Apply Only to Properties Under $600k

Victoria’s first-home stamp duty exemptions are largely irrelevant in Niddrie, where the median house price is $1.16M–$1.26M.

TIP: Budget for full stamp duty (e.g., approximately $68,000 for a $1.2M property) unless purchasing units ($688k–$710k median), where partial concessions may apply.

Subdivisions: GRZ Zoning Allows Subdivisions on Lots Over 300m²

General Residential Zone (GRZ) rules in Niddrie permit subdivisions if lot sizes exceed 300m², subject to council approval.

TIP: Subdividing will show you development potential, but approval timelines (3–12 months) and costs ($15k–$50k) must be factored in. The Niddrie Activity Centre Plan prioritizes housing density, making subdivisions more viable.

Short-Term Rentals: Maribyrnong Council Requires Registration for Stays Under 30 Days

Airbnb hosts must register properties and comply with safety standards.

TIP: Non-compliance risks fines exceeding $1,800. Investors should note rental yields: approximately 2.7% for houses versus 5.2% for units, with median rents at $650/week (houses) and $525/week (units).

FAQ About Niddrie, Melbourne, Conveyancing

Can you negotiate conveyancing fees based on property type, like heritage homes or townhouses?

Yes. Fees change depending on property complexity. Heritage homes usually sit between $800–$1,200 because of extra checks like heritage overlays. Townhouses often cost $650–$900. Most Niddrie firms use fixed pricing, but some adjust based on how involved the work is.

Do Niddreie conveyancers check if past renovations had council approval?

A skilled conveyancer will thoroughly review the Yes. They go through Maribyrnong City Council records to confirm if permits exist. If something wasn’t approved, it might lead to renegotiation or require permits before the settlement goes through. Maribyrnong City Council records include official property-related documents held by the local council.

Records can include:

- Building permits – show if past renovations were approved

- Planning permits – cover zoning rules, overlays, and land use permissions

- Flood maps – highlight areas with flood risk

- Heritage listings – show if a property is restricted or protected

- Compliance reports – confirm whether past work meets council standards

Good conveyancers in Niddrie always check council records to find problems early and confirm the property follows legal requirements before anything gets signed.

How can you tell if a conveyancer understands Niddrie’s flood overlay zones?

Ask if they review local flood maps around Niddrie Burn and Burdiehouse Burn. Experienced conveyancers add flood-risk terms to the contract and confirm that the property complies with drainage rules.

Will a conveyancer help with stamp duty concessions paid by the seller?

No. They don’t negotiate with sellers over who pays what. But they do structure contracts to help you qualify for things like Victoria’s first-home exemption or off-the-plan discounts.

Can you ask a conveyancer to come with you to a property inspection?

Only in rare cases. If the property has disputed boundaries or similar issues, they might come. Most work from the title docs and building reports instead.

Do conveyancers deal with chattels left behind by the seller?

Yes. If the contract lists what stays and the seller leaves stuff out, your conveyancer can act on it. Clear paperwork before the sale prevents drama later.

How do you check if a conveyancer has experience with multicultural property transfers?

Ask what kind of deals they’ve done. Look for experience with foreign ownership rules, FIRB approvals, and contracts in multiple languages. Good Niddrie conveyancers will mention this upfront.

Can a conveyancer predict delays from local road projects like Keilor Road upgrades?

No. But they follow local project updates and write in flexible settlement dates in case things get held up due to council work near the property.

Will a conveyancer check if your investment property can be rented on Airbnb?

Yes. They review Maribyrnong Council short-stay rules and zoning laws to confirm what’s allowed. If the property doesn’t follow the rules, it could result in fines or forced eviction.

Do Niddrie conveyancers give advice after settlement if you want to subdivide your backyard?

Some do, some don’t. It depends on their experience with planning rules and how much support they offer beyond standard conveyancing.

Conveyed gives you clear guidance if you plan to subdivide. With deep knowledge of Niddrie zoning and permit steps, you get advice that shows exactly what to do next.