Title Insurance

Protect yourself from financial loss, legal errors, disputes and expenses. Prevent and minimise risks of fraud, forgery, liens and encumbrances.

Get title insurance before a property transfer – you need security against unforeseen claims that could affect property ownership.

What Does Title Insurance Cover?

A one-time payment at the time of purchase provides lifelong protection against these risks:

- Errors in public records

- Fraud and forgery

- Undisclosed heirs

- Unpaid debts or liens

- Conflicting wills

- Missing documentation

- Boundary disputes

Protect your investment before it’s too late!

5 Situations Title Insurance DOES NOT Cover

1

Physical defects or maintenance problems

2

Environmental contamination, such as polluted land

3

Risks that the policyholder created or agreed to

4

Physical damage from future events like fire or flood

5

Issues caused by the new owner after the settlement

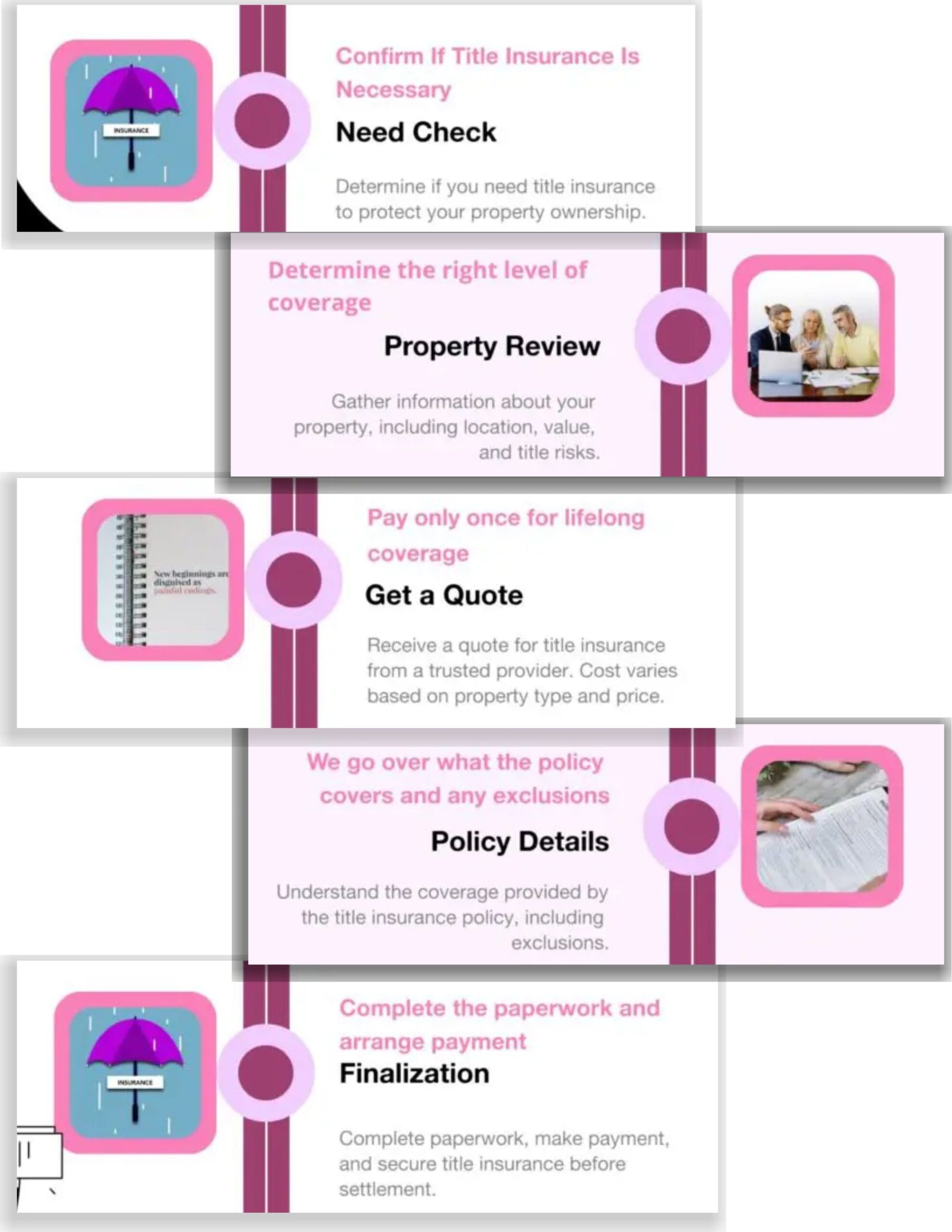

What We’ll Do for You

For you, Conveyed will:

- Confirm if you need title insurance

- Determine coverage level (property location, value, and title risk factors affect the insurance price)

- Request pricing to find the optimal option for you

- Review policy scope to confirm that inclusions and exclusions match the situation

- Complete paperwork and payment

Estimated Title Insurance Costs (Victoria/Melbourne)

Here’s what current sources show about title insurance costs in Melbourne and how pricing is generally calculated in Australia (note that exact figures for Melbourne vary by insurer and property value):

| Purchase price | Title insurance price range |

|---|---|

| Under $500,000 | $350 to $650 |

| $500,000 to $750,000 | $500 to $850 |

| $750,000 to $1,000,000 | $650 to $1,050 |

| $1,000,000 to $1,500,000 | $900 to $1,600 |

| Above $1,500,000 | $1,400 to $2,500 |

Please be aware that these were average prices in 2025. Since dozens of factors affect the price, the premium is calculated for every property individually.

Pricing differences appear between insurers even for identical property values.

The Main Factors that Affect the Title Insurance Policy Price in Melbourne

Title insurance in Victoria is a single one-off payment, not an annual cost, and the price is mainly driven by property value plus risk profile.

- Purchase Price of the Property: The premium is primarily calculated as a percentage of the purchase price.

- Property Type: Houses, strata units, vacant land, and commercial premises carry different risk levels. Commercial and development properties have higher premiums.

- Intended Use: Owner-occupied homes, investment properties, SMSF purchases, and development projects present different risk profiles.

- Policy Type: Standard residential cover costs less than extended or commercial policies.

- Transaction Type: Purchase, refinance, off-the-plan acquisition, or related-party transfer influences insurer assessment.

- Title Risk Complexity: Older titles, easements, heritage overlays, zoning restrictions, or boundary inconsistencies increase insurer exposure.

- Strata vs Torrens Title: Strata properties often carry lower risk compared to standalone dwellings of equal value.

- Location Factors: Flood zones, bushfire overlays, environmental controls, and council compliance history. Higher regional risk increases policy cost.

- Insurer Pricing Schedule: Each provider applies its own premium scale.

Real-Life Examples and Testimonials

“We bought our first home in Melbourne, thinking everything was sorted. A few months later, a letter arrived—apparently, the previous owner had unpaid council rates and a contractor’s lien of $25,000. We had no clue this could even happen! Luckily, we had title insurance, and it covered everything. Without it, we would’ve been stuck paying someone else’s debt. Absolute lifesaver!” — Sophie & James, first-home buyers, Melbourne

“After we bought our place in Melbourne’s west, we found out the previous owner had done a dodgy reno without council approval. A few months later, we got a letter saying we either had to tear it down or fix it up to code—costing a whopping $160,000. Thankfully, we had title insurance, and it covered the whole lot. If we hadn’t taken our conveyancer’s advice, we’d be out of pocket and in a world of stress. Best money we spent during the whole process.” — Ben, homeowner, Melbourne

“We were in the final stages of settling when the bank flagged something weird—the seller’s ID was fake. Someone had been trying to sell a house they didn’t even own. If we hadn’t caught it, we could’ve lost our entire deposit and been stuck in a legal battle. Our title insurance kicked in, covered our legal fees, and helped us recover everything. Best $500 we ever spent!” — Emma & Josh, young couple, Melbourne

8 Reasons to Obtain Title Insurance

If you do not get title insurance before the property transfer is complete, you could face claims from past owners or unpaid debts tied to the property. Errors in public records can create legal battles that cost time and money. Title insurance protects your investment. With it, your ownership is legally sound and free from hidden issues.

1. Ownership Disputes: You don’t want to buy a property only to find out someone else has a claim to it. Title insurance protects you from past ownership disputes, unknown heirs, and fraudulent deeds that could put your purchase at risk.

2. Hidden Liens and Unpaid Debts: The last thing you need is to inherit someone else’s financial problems. Title insurance shields you from unpaid taxes, contractor liens, or undisclosed mortgages that could cost you thousands.

3. Errors in Public Records: Mistakes happen—misspelled names, incorrect legal descriptions, or misfiled paperwork can cause major headaches. With title insurance, you’re covered against costly clerical errors that could affect your ownership rights.

4. Fraud and Forgery Risks: Scammers can forge signatures, fake property transfers, or steal identities to manipulate deeds. Title insurance helps you fight back against fraudulent claims that could threaten your property rights.

5. Lender Requirements and Loan Protection: If you’re financing the purchase, your lender will likely require title insurance.

6. Expensive Legal Battles: Without title insurance, you could end up in a costly court fight to defend your ownership. A title policy covers legal fees and prevents drawn-out disputes that could drain your savings.

7. Survey and Boundary Issue: If there’s a conflict over property lines, encroachments, or easements, title insurance stems from costly disputes with neighbours or unexpected zoning problems.

8. Future Resale Roadblocks: When it’s time to sell, a clean title speeds up the process and keeps buyers from walking away. Title insurance guarantees there are no lingering issues that could delay or derail your sale.

Get your quote today.

Relax knowing our experts are handling your property conveyancing.

3 Title Insurance Definitions

What Is Title Insurance?

Title insurance is a policy that protects property owners and lenders from financial loss due to issues with a property’s ownership history. It covers problems that could arise from errors in public records, hidden claims, fraud, or legal disputes over ownership rights.

What Is the Purpose of Title Insurance?

The purpose of title insurance is to provide security against unforeseen claims that could affect property ownership. It guarantees that the buyer receives a property with a valid and undisputed title. If a past issue surfaces after the transfer, the insurance covers financial losses and legal costs.

What Does Title Insurance Cover?

The purpose of title insurance is to provide security against unforeseen claims that could affect property ownership. It guarantees that the buyer receives a property with a valid and undisputed title. If a past issue surfaces after the transfer, the insurance covers financial losses and legal costs. Title insurance covers various risks related to property ownership, including:

- Boundary disputes – Claims that challenge property lines or legal access.

- Errors in public records – Mistakes in past ownership documents that could affect legal rights.

- Fraud and forgery – Fake signatures, fraudulent property transfers, or identity theft.

- Undisclosed heirs – Relatives of previous owners claiming rights to the property.

- Unpaid debts or liens – Outstanding mortgages, taxes, or contractor fees tied to the property.

- Conflicting wills or missing documentation – Disputes over inheritance or lost legal records.

FAQs

How is title insurance different from home and contents insurance in Victoria?

A standard home and contents insurance policy in Victoria covers physical structure damage from fires or storms. A title insurance policy covers legal risks related to your property title and legal ownership, which protects you from financial loss due to a previous owner or unknown risks.

How much does title insurance cost and do I pay yearly?

You pay a one-off premium calculated based on the purchase price of your residential property or vacant land. There are no ongoing annual fees. Title insurance provides lifelong protection for the property owner from the policy date. Ask Conveyed to include the exact title insurance cost in your overall settlement services estimate.

Does the policy cover illegal building works?

Yes. A local council might issue council orders forcing you to demolish unapproved structures built by a previous owner without council approval. A title insurer covers the legal costs and rectification expenses for hidden risks. Have Conveyed check for existing permits during the conveyancing process to expose any known risks early.

Can existing homeowners purchase a policy?

Yes, even if you bought your house years ago. That’s how existing homeowners get protected against a person’s fraud or newly discovered boundary lines and boundary issues that threaten their home’s market value. Contact a title insurance provider directly to secure coverage for the property you already own.

Do I still need building inspections?

Yes. Building inspections check the physical condition for defects like termites or bad wiring. A title insurance policy is a risk management tool for legal risks, title defects, and outstanding rates not found during a standard title search. Book a licensed building inspector while we handle your due diligence.

Do buyers in Victoria need this under the Torrens system?

The Torrens system guarantees the state registry is correct. It does not protect home buyers against a person’s fraud, compulsory land acquisitions, or unapproved works missing from public records. Speak to Melissa or someone else on our team to make an informed decision about your specific personal circumstances.

Do I pay stamp duty on the premium?

The premium quoted by a title insurance provider like First Title or Stewart Title generally includes all applicable government taxes. You pay this alongside your property purchase costs during real estate transactions.

Will the insurer cover identified risks found before settlement?

Insurers generally only cover unknown risks discovered after the property transfer. If a title search reveals existing ownership issues or boundary disputes beforehand, coverage applies only in limited circumstances and requires special approval from the parent company underwriters. Send any suspicious property documents to us immediately so we can find practical solutions before you sign.

What happens if the government claims my land in Victoria?

A government authority might execute compulsory land acquisitions that were not disclosed on the property title or public records before your purchase. Insurance compensates covered homeowners for the loss of land and market value in such situations.

Is claiming against a title defect a time-consuming process?

It all depends on the complexity of the legal issues. Once you notify your title insurer about unexpected issues like fraud or unapproved building works, their internal legal team manages the dispute.