This article explains the key parts of Bayside conveyancing, including local property laws and the important role of a conveyancer. It discusses why using a local expert is beneficial, points out common mistakes to avoid, and offers practical tips to make your conveyancing process efficient and stress-free.

Easy Sep-by-Step to Find and Hire a Good Conveyancer in Bayside

- Search for Conveyancers Who Work in Bayside

Use Google or legal directories to find conveyancers who operate in Bayside. Don’t limit your search to only those physically based there—what matters is whether they regularly handle properties in the area and know how the local rules work. - Ask for Recommendations Without Wasting Time

- If you’re using a real estate agent, ask them who they’ve worked with on Bayside properties.

- Use Facebook groups or forums linked to Bayside. Look for threads about recent property sales and ask who people used.

- Ask around—friends, coworkers, family. If someone bought or sold in Bayside recently, they’ll remember their conveyancer.

- Check Their License – Confirm the conveyancer is licensed with the Business Licensing Authority (Victoria). If they aren’t licensed, they can’t legally handle your transfer. If you hire them, you risk legal and financial damage.

- Confirm Experience with Bayside Properties

Ask:

- “How many properties have you handled in Bayside recently?”

- “Are you familiar with the local council, zoning, and planning rules there?”

If they don’t know how Bayside works, your deal might hit delays or fail due to missed council conditions or incorrect advice.

- Get a Clear, Written Quote

Request an itemized breakdown showing:

- Service fee (flat or percentage)

- Government charges

- Search and registration costs

Any extras

Typical costs in Bayside, Melbourne:

- Conveyancers: $800 to $2,500

- Settlement agents: $700 to $1,500

If you don’t ask, you could get charged double later with no warning.

- Talk to Them Directly

Ask:

- “Who will actually do the work on my file?”

- “How fast do you respond to emails or calls?”

- “How do you keep me updated?”

If they don’t give straight answers, that’s a problem.

- Check They Have Insurance – They must have professional indemnity insurance. If they mess up and have no insurance, you might have no way to recover lost money.

- Look at Client Reviews Specific to Bayside – Find reviews from people who sold or bought property in Bayside. Google reviews, forums, or testimonials—check if people mention the area, not just vague praise.

- Get a Contract Before Work Starts

Sign a written agreement covering:

- Their responsibilities

- What you’ll pay

- Timeframes

- Terms if things go wrong or you want to cancel

Without this, they can delay, overcharge, or disappear, and there’s nothing you can do about it.

Insights on Local Property Laws

When dealing with property transfers, first-home buyers should know legal obligations, property rights, and the necessary due diligence for a worry-free transaction. An experienced conveyancer in Bayside will guide you through the complex process, guaranteeing compliance with all relevant local and regional laws while protecting your interests.

Key Statistical Data Related to Property Transactions in Bayside

Bayside, a sought-after suburb in Melbourne, has experienced significant changes in its real estate market, particularly affecting conveyancing and first home buyers.

Median Prices in Bayside

As of Q1 2024, the median house price in Bayside is $910,000, while the median unit price is $590,000. This reflects an annual growth of 11.3% for houses and 18.6% for units from Q1 2023 to Q1 2024.

- The most common price range for houses sold was between $750,000 and $849,999, accounting for 27.4% of sales.

- For units, the dominant range was $450,000 to $549,999, accounting for 31.6% of sales.

Sales Trends

House sales decreased by 2.9% (to 200 sales), while unit sales saw a more significant drop of 29.7% (to 26 sales). The average time on the market for properties has declined dramatically by 28.6%, resulting in an average of just 15 days, indicating a competitive market.

Rental Market

The rental yield for houses in Bayside stands at 4.4%, with a median rental price of $680 per week, reflecting a 6.3% increase over the past year. The vacancy rate is notably low at 0.8%, which is below the healthy benchmark of 3.0%, suggesting strong demand for rental properties.

Trends Affecting First Home Buyers

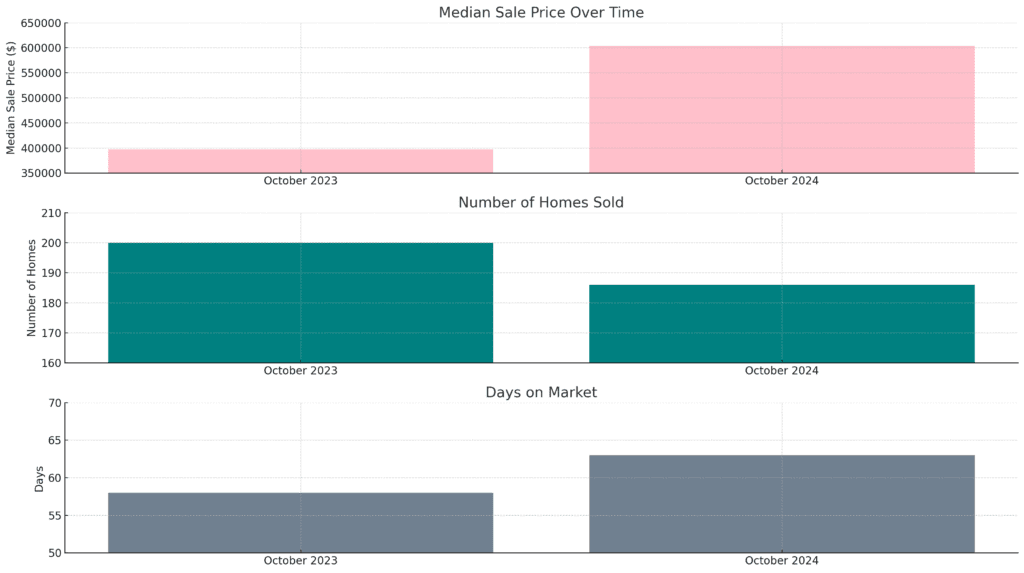

- Median Sale Price: In October 2024, the median sale price of homes in Bayside reached $604,000, reflecting an increase of 52.3% compared to the previous year.

- Days on Market: Homes in Bayside sold after an average of 63 days on the market, compared to 58 days last year.

- Sales Volume: A total of 186 homes sold in October 2024, down from 200 homes sold in October 2023.

- Sale-to-List Price Ratio: The sale-to-list price ratio stood at 97.3%, which is a slight increase of 0.2 percentage points year-over-year.

- Median Sale Price Over Time

- October 2023: Approximately $397,000 (based on a 52.3% increase)

- October 2024: $604,000

- Number of Homes Sold

- October 2023: 200 homes

- October 2024: 186 homes

- Days on Market

- October 2023: 58 days

- October 2024: 63 days

Increased Activity Among First Home Buyers

There has been a noticeable rise in new home loan commitments among first home buyers, with a reported increase of 2% in September 2024. The uptick suggests growing confidence among first home buyers regarding market conditions and affordability.

Affordability Challenges

Despite the overall growth in property prices, there are still affordable options available within Bayside, particularly for units and lower-priced homes. The competitive nature of the housing market necessitates that first-home buyers look towards outer suburbs or less expensive areas to find suitable properties.

Government Housing Targets

The Victorian Government has proposed a target to increase housing by 70% by 2051, which will greatly impact the character and liveability of Bayside. The proposed increase poses challenges in terms of infrastructure and community services to support new residents.

Future Developments

Bayside is slated to see approximately $314.3 million worth of new residential projects commencing in the first half of 2024, which includes units and townhouses aimed at addressing housing supply issues. Developments alleviate some pressure on the housing market and lead to increased competition among buyers.

The Role of a Conveyancer

Conveyancers in Bayside manage the complexities of property transactions amid fluctuating market conditions. Their expertise supports compliance with local zoning laws and regulations, providing indispensable assistance to buyers.

With property prices rising and competition intensifying, the role of conveyancers is more important than ever to facilitate seamless and lawful property transfers, underscoring their profound influence on Bayside’s real estate dynamics. When hiring a conveyancer, expect a thorough understanding of the legal process in property transactions. A skilled conveyancer will safeguard your property rights and provide clear information about fees, making the process smooth.

Your Bayside conveyancer must establish open and clear communication throughout the transaction. A skilled conveyancer will handle the paperwork and legal requirements while keeping you updated on important timelines and decisions.

Benefits of Using a Local Conveyancer

Local conveyancers have deep knowledge of the Bayside real estate market, providing helpful guidance during property transactions. The familiarity with neighborhood trends and property research authorizes them to give optimal advice to buyers and sellers. Connections with local professionals, such as inspectors, appraisers, and contractors, improve transaction management.

Benefits of Working With Conveyed in Bayside

As experienced conveyancers, we have built strong connections with local professionals like inspectors, appraisers, and contractors. Such relationships significantly improve the management of property transactions, increasing accuracy and efficiency throughout the process.

Working closely with skilled inspectors allows us to quickly spot potential property issues, impacting negotiations or future liabilities for buyers. Our network of trusted appraisers provides accurate market valuations critical for securing fair purchase prices and appropriate financing. Reliable contractors are available to offer quick estimates and repairs, vital for meeting closing timelines or addressing conditions set during the sale process.

Data shows that transactions handled by conveyancers with robust local networks encounter 80% fewer delays compared to those managed by individuals without such connections. Our clients consistently report higher satisfaction, noting the efficient handling and clear communication throughout the entire conveyancing process.

Common Pitfalls a Bad Bayside Conveyancer Might Cause

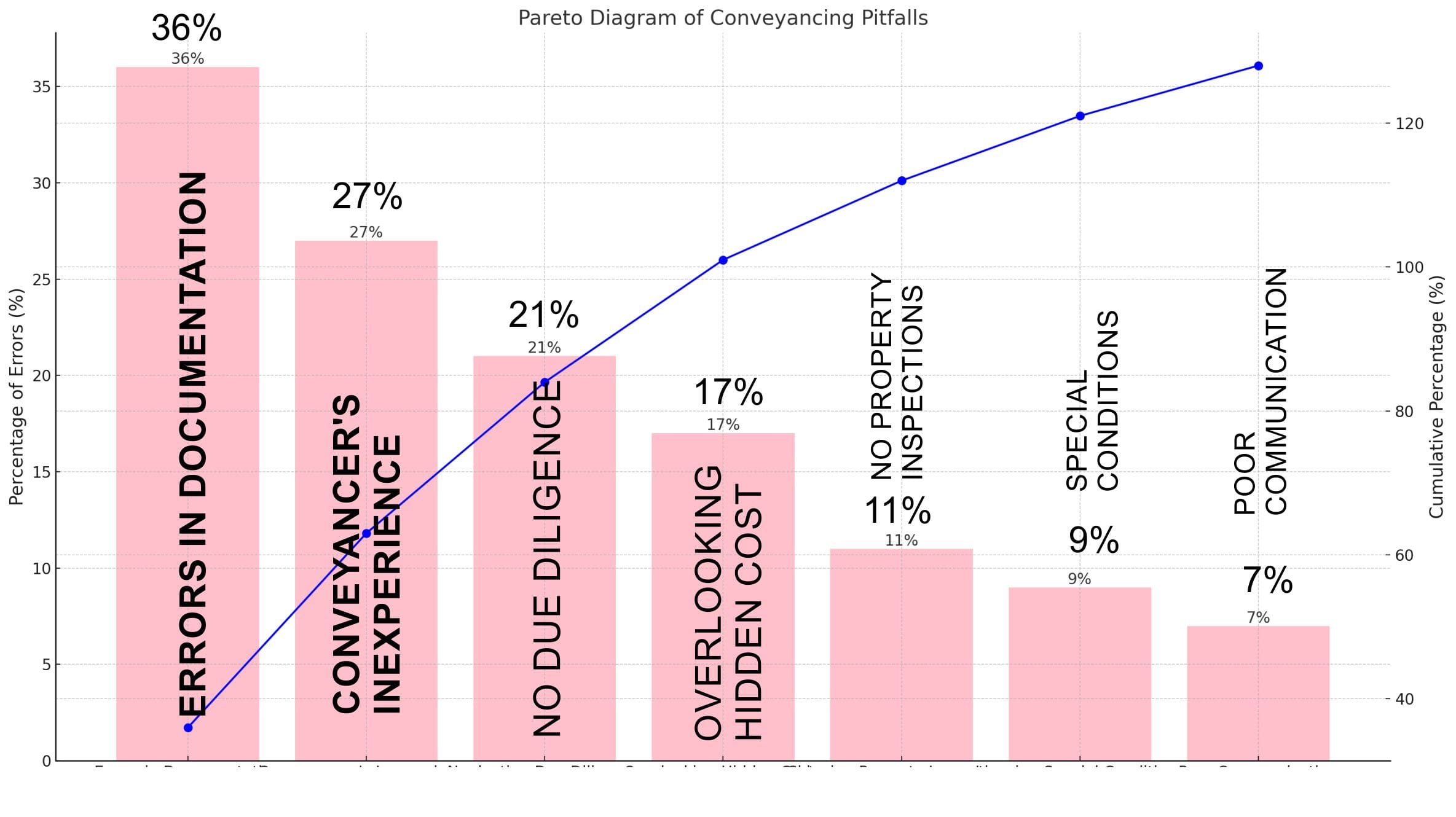

Risks of Hiring an Inexperienced Conveyancer

Employing a conveyancer without adequate experience in the Bayside area leads to severe financial repercussions. Inexperienced conveyancers often lack a full understanding of local property laws, increasing the likelihood of costly errors. Errors will delay transactions by weeks or even months, potentially costing clients thousands in additional legal fees and missed opportunities.

For example, a failure to detect a special zoning restriction will delay a sale, costing a buyer upwards of $10,000 in missed tax benefits and additional rental expenses.

Consequences of Poor Communication

Clear and prompt communication is vital in conveyancing. A conveyancer who fails to communicate effectively causes delays and misunderstandings, potentially prolonging the transaction process by days or weeks. Delays result in higher holding costs and missed market opportunities, impacting clients financially.

In severe cases, the lack of timely updates might force a buyer to extend temporary housing, incurring extra costs of approximately $2,000 per month.

Significance of Thorough Due Diligence

Performing thorough due diligence is critical to identifying any legal encumbrances or zoning issues that might affect the property’s value. If you neglect this step, you expose yourself to unexpected legal challenges that cost significant amounts in resolution fees and decrease property value.

For example, undiscovered easements will lead to legal disputes, potentially costing over $5,000 in legal fees and a reduced property resale value by 5-10%.

Impact of Overlooking Hidden Costs

Underestimating additional costs such as stamp duty, legal fees, and disbursements leads to substantial financial strain. Buyers who fail to budget for the listed expenses will be unable to complete transactions, incurring further costs.

An unexpected legal fee or stamp duty will add up to $15,000 to the overall cost, pushing buyers beyond financial limits.

Outcomes of Documentation Errors

Mistakes or omissions in essential documents cause significant delays and complications during the conveyancing process. All paperwork must be accurate and complete before submission to avoid costly corrections and legal challenges.

Incorrect documentation will lead to a three-month delay in property settlement and financial losses from paying fines or penalty rates, possibly exceeding $8,000.

Special Conditions in Contracts

Special conditions in a contract significantly impact the transaction. If you fail to identify or address conditions, you trigger disputes or unexpected obligations, potentially resulting in costly legal battles.

Suppose you or an inexperienced conveyancer ignore a clause regarding property boundaries. In that case, it will lead to litigation, with legal expenses and settlement costs that could surpass $20,000, alongside the risk of losing the property.

The Necessity of Proper Property Inspections

If you neglect proper property inspections, you risk costly surprises after purchase. Buyers must conduct thorough inspections to identify any potential defects or issues before finalizing the sale.

If you skip an inspection, that could reveal structural damages post-purchase, it will cause repair costs upward of $30,000 and a potential decrease in property value. Your conveyance in Bayside will know how, when, and where to approach inspectors, how much their services will cost, and which are the best in the Bayside area.

Tips to Choose a Good Bayside Conveyancer

To prepare for the conveyancing process, staying organized is crucial for managing property documents and handling legal procedures smoothly. Keeping track of all documents, deadlines, and communications will make the transaction more efficient. Create a dedicated folder -physical or digital -for storing all important documents, such as contracts, title deeds, and identification papers, to prevent misplacement and have quick access when needed.

Establish a clear communication strategy with all involved parties, including the seller’s agent, legal representatives, and mortgage lenders. Regular check-ins and updates will prevent misunderstandings and delays.

Get your quote today.

Relax knowing our experts are handling your property conveyancing.