Several factors greatly influence the cost of conveyancing services in Australia. Therefore, you should always request a detailed breakdown of costs from your conveyancer. In this post, we give you averages and estimates based on our extensive 10+ year-long practice in Victoria, New South Wales & Queensland.

Conveyancing Fees Melbourne: Best Guide for First Time Buyers

7 Key Factors Influencing Conveyancing Costs

1. Property Type

- Residential vs. Commercial: Due to their complexity, conveyancing for commercial properties generally incurs higher fees. Leasehold properties have additional legal requirements, leading to increased costs compared to freehold properties.

2. Location

- State Variations: Different states have varying regulations and requirements, impacting costs. For example:

- New South Wales (NSW): Average fees are around $1,800.

- Victoria: Average fees are approximately $1,200.

- Queensland: Fees are about $1,000.

- Local Regulations: Properties in urban areas face different search fees and legal requirements compared to rural locations.

3. Complexity of the Transaction

- Transaction Details: More complex transactions (e.g., shared ownership, title defects, or planning restrictions) require additional work and thus incur higher fees. Transactions with higher sale prices also incur higher conveyancing fees due to the greater responsibility and risk involved.

4. Sale Price

- Higher property values generally result in higher conveyancing costs as they involve more extensive due diligence and legal scrutiny. For instance, properties valued over $1 million have additional charges due to the increased complexity of transactions.

5. Additional Services

- Extra Work: If you require additional services (e.g., arranging leasehold information or dealing with planning restrictions), they lead to extra charges beyond the standard conveyancing fee.

- Hidden Costs: Be aware of potential hidden costs, such as extra searches or administrative fees, that will not be included in the initial quote.

6. Professional Type

- Conveyancer vs. lawyer: Licensed conveyancers charge lower fees than lawyers. However, lawyers provide broader legal expertise, which is beneficial for more complex transactions.

7. Government Fees

- Additional costs, such as stamp duty and registration fees, greatly impact overall expenses. They vary by state and are based on the property’s value:

- Stamp duty ranges from 1% to over 5% of the property’s value, depending on the state and specific circumstances.

Table of Factors Influencing Conveyancing Costs

| Factor | Influence on Cost |

| Property Type | Higher for commercial/leasehold properties |

| Location | Varies by state and urban vs rural differences |

| Complexity of Transaction | More complex = higher fees |

| Sale Price | Higher value = higher costs |

| Additional Services | Extra charges for non-standard services |

| Professional Type | Conveyancers are cheaper than lawyers |

| Government Fees | Varies by state; substantial impact |

Hidden or Unexpected Costs

Additional hidden or unexpected costs associated with property transfer might seriously impact your budget.

Chancel Repair Liability

Chancel repair liability imposes historical financial obligations for repairs, potentially costing tens of thousands of dollars. Insurance for this liability costs around $48 for a standard residential property with $190,000 indemnity.

Compliance Fees

Compliance costs arise from covenants or restrictions requiring fees for documentation or approvals, which, depending on their complexity, range from $190 to $950.

Moving Expenses

Moving costs vary widely. Depending on the distance and volume of belongings, hiring professional movers costs between $570 and $2,850, while packing materials add another $95 to $380.

Repairs and Maintenance

Additionally, unexpected repairs and maintenance issues identified during inspections may require immediate attention, leading to costs that run from a few hundred to several thousand dollars.

Home Insurance

Home insurance is generally required before completion and varies based on property value; average premiums are around $570 to $1,900 annually.

Utility Connection Fees

Utility connection fees for electricity, gas, and water also add up, typically costing between $95 and AUD 380 per utility service.

Property Management Fees

If the property is part of a managed estate or block of flats, ongoing property management fees may apply, averaging around $190 to $570 monthly.

Surveyor Fees for Additional Surveys

Surveyor fees for additional surveys, such as Homebuyer Reports or Building Surveys, go from $760 to $1,900 depending on the property’s size and location.

Title Deed Retrieval Fees

Lastly, if original title deeds need retrieval due to complications, this will incur extra charges of approximately $95 to $285.

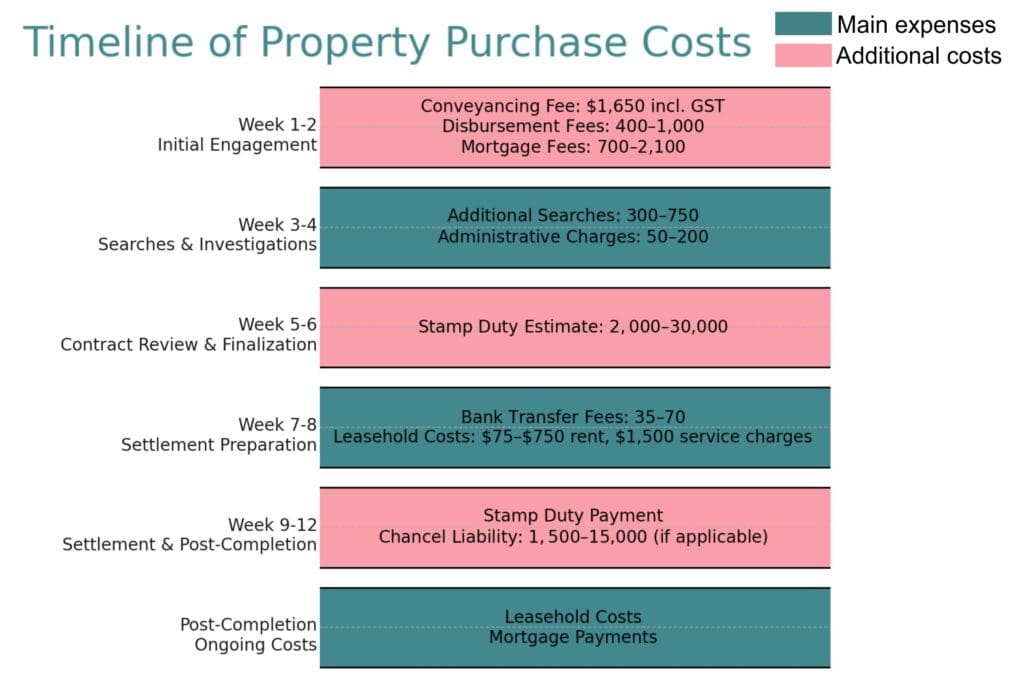

Payment Timeline

The entire property purchase and conveyancing process lasts 6 to 12 weeks. Below is a timeline showing the expected moments or periods (in weeks) when fees or expenses may arise. The timeline provides clarity on when to expect key expenses during the property purchase and conveyancing process.

Week 1–2: Initial Engagement

- Conveyancing Fee (Including VAT): Paid upon engaging the conveyancer. For example, if the base fee is $1,500, the total with GST is $1,650.

- Disbursement Fees: Initial costs for property searches and land registry fees ($400–$1,000) may be requested upfront.

- Mortgage Arrangement Fees (if applicable): Some lenders require payment for arrangement or valuation fees early in the process, ranging from $700–$2,100.

Week 3–4: Searches and Investigations

- Additional Property Searches: If required, extra searches cost $300–$750. They arise after the initial engagement but before the contract is finalised.

- Administrative Charges: Small fees for document preparation or photocopying, $50–$200.

Week 5–6: Contract Review and Finalization

- Stamp Duty: An exact calculation for stamp duty will be confirmed after the contract is finalized. Payment is made immediately before or at settlement. As already said, it varies based on property value and location ($2,000–$30,000).

Week 7–8: Settlement Preparation

- Bank Transfer Fees: Payments for multiple transactions, such as deposit transfers and settlement funds, $35–$70 per transfer.

- Leasehold Costs (if applicable): Ground rent ranges from $75 to $750 per year, and service charges average $1,500 annually.

Week 9–12: Settlement and Post-Completion

- Stamp Duty Payment: The due date for stamp duty is within 30 days of settlement.

- Chancel Repair Liability (if applicable): Rare but substantial expenses averaging $1,500–$15,000 could arise if identified in property searches.

Ongoing Costs After Completion

- Leasehold Costs: Annual service charges and ground rent payments continue after the purchase.

- Mortgage Payments: If financed, regular mortgage payments begin post-settlement.

Conveyancing Fees by State

Conveyancing fees in Australia vary across different states and territories, influenced by factors such as local regulations, property values, and the complexity of transactions. Below is a summary of the usual conveyancing fees by state.

| State/Territory | Average Fee Range (AUD) |

| Queensland | $850 – $1,450 |

| New South Wales | $1,100 – $2,200 |

| Victoria | $600 – $1,500 |

| South Australia | $750 – $1,750 |

| Western Australia | $1,000 – $1,600 |

| Tasmania | $1,200 |

| Northern Territory | $990 – $2,000 |

Breakdown of Conveyancing Costs by State

- Queensland: Conveyancing fees vary from $850 to $1,450, depending on the city and complexity of the transaction.

- New South Wales (NSW): Fees are generally higher, averaging between $1,100 and $2,200, reflecting the market’s complexity.

- Victoria: The average cost is around $600 to $1,500, with some variation based on the specific location within the state.

- South Australia: Fees fall between $750 and $1,750, with lower costs observed in Adelaide compared to regional areas.

- Western Australia: Standard conveyancing costs go from $1,000 to $1,600, influenced by the property type and location.

- Tasmania: The cost is generally around $1,200, consistent across various transaction types.

- Northern Territory: Fees vary from $990 to $2,000, reflecting the unique market conditions in this region.

Additional Considerations for First-time Buyers

In addition to professional fees, first time buyers should be aware of disbursement costs. They are separate from conveyancing fees and cover third-party expenses incurred during the transaction process. Common disbursements include:

- Title searches

- Council rates search

- Building inspections

- Settlement fees

Disbursement costs will add several hundred dollars to the overall expense of conveyancing, depending on the services required. Obtain multiple quotes and clarify what is included in the fee structure to avoid unexpected costs.

Common Hidden Costs in Conveyancing

Here are the key hidden costs to be aware of in conveyancing:

- Disbursement Fees are incurred by the lawyer on behalf of the client for third-party services, such as property searches and land registry fees. They range from $400 to $1,000, depending on the services required.

- Value-Added Tax (VAT): In Australia, solicitors must charge GST (Goods and Services Tax) on their services, which adds approximately 10% to total conveyancing fees. If the base fee is $1,500, the total, including GST, would be $1,650.

- Administrative Charges: Additional fees apply for tasks such as document registration with the Land Registry, bank transfer fees for moving funds, or photocopying charges. Although minor individually, they accumulate over time. Administrative charges average around $50 to $200.

- Stamp Duty: One of the largest expenses in property transactions and varies based on the property’s value and location. The average stamp duty in Australia goes from $2,000 to $30,000.

- Property Searches: Standard searches are included in conveyancing fees; however, depending on the property’s location or specific circumstances, additional searches may be necessary. Extra searches incur additional costs, averaging around $300 to $750.

- Mortgage Fees: If the property is financed through a mortgage, various fees arise, including arrangement fees and valuation costs- which average between $700 and $2,100, depending on the lender and mortgage type.

- Leasehold Costs: ongoing costs related to ground rent and service charges that need to be considered before finalising the purchase. Ground rent runs from $75 to $750 per year, while service charges average around $1,500 annually.

- Bank Transfer Fees: Multiple bank transfers are often necessary throughout the process, leading to additional fees that quickly add up, generally around $35 to $70 per transfer.

- Chancel Repair Liability: In rare cases, some properties have historical liabilities for repairs to local parish churches. The potential liability averages around $1,500 to $15,000.

Disbursement Costs in Conveyancing

Conveyancing disbursement costs depend on several factors, including the location of the property, the complexity of the transaction, and the specific services required. Disbursements are fees paid to third parties for services related to the conveyancing process, in addition to the legal fees charged by your solicitor or conveyancer.

Here are some common disbursement costs you will encounter during a conveyancing process (besides the Stamp Duty Land Tax mentioned above):

- Land Registry Fees: From AUD 30 for properties valued under AUD 80,000 to up to AUD 1,500 for properties over AUD 1,000,000. The fee is fixed and depends on the property’s value.

- Local Authority Searches: Between AUD 450 and AUD 800, depending on the local council’s rates. This search checks for any local issues that could affect the property.

- Environmental Searches go from AUD 50 to AUD 60 plus GST. They assess risks such as flooding or contamination.

- Drainage Searches cost between AUD 50 and AUD 60 plus GST and confirm that the property is connected to sewage systems.

- Bankruptcy Searches: Generally cost between AUD 3 and AUD 7. This search verifies whether any parties involved in the transaction have been declared bankrupt.

- Telegraphic Transfer Fees: Charged by banks for transferring funds, they vary from AUD 30 to AUD 60 plus GST.

How Do Property Value And Type Affect Conveyancing Fees

The value and type of property greatly impact conveyancing fees, which are the costs associated with the legal transfer of property ownership.

Property Value

- Higher Fees for Higher Values: Generally, as property values increase, so do conveyancing fees. Higher-value transactions normally require more extensive legal work, including due diligence, title searches, and negotiations. Conveyancers charge fees based on a percentage of the property’s value, making it crucial to consider this when budgeting for a transaction.

- Complex Transactions: More expensive properties involve intricate legal issues or additional paperwork, which increases time and effort from the conveyancer.

Property Type

- Leasehold vs. Freehold: The type of property plays a critical role in determining conveyancing fees. Leasehold properties incur higher fees due to the additional complexities involved, such as reviewing lease agreements and managing ground rents or service charges. In contrast, freehold properties naturally involve a more straightforward process.

- Commercial vs. Residential: Different types of properties (residential, commercial, or rural) affect costs. For instance, commercial properties require specialised legal knowledge and additional documentation, resulting in higher fees compared to standard residential transactions.

- New Builds: Conveyancing for new build properties incurs higher costs due to the unique considerations involved, such as compliance with building regulations and involvement with developers.

Final Thoughts About Conveyancing Fees

Now that you know all the costs you may face and a rough timeline of when you are expected to pay, plan your budget ahead. Based on thousands of transactions we have handled so far, the optimal time to start preparing your budget is 2–3 weeks before initiating a property purchase.

With a good Melbourne conveyancer, you can postpone planning until after you hire them. When working with our clients, we help sort out expenses and provide a clear timetable. With us, you’ll never be surprised by conveyancing fees or encounter hidden costs. Reach out now for a quote, and let’s get to work.

Get your quote today.

Relax knowing our experts are handling your property conveyancing.